Moving to South Florida is an exciting adventure! But navigating the homebuying process in this vibrant region can be tricky. To help you establish into your new life, here's a rundown of essential tips for newcomers:

* First, determine your budget and get pre-approved for a mortgage. This will give you a clear concept of what you can afford.

* Next, research different neighborhoods to find the perfect fit for your lifestyle. South Florida offers a variety of choices, from bustling city centers to laid-back beach towns.

Think about factors like commute time, schools, and amenities when making your decision.

* Once you've found a few promising properties, schedule showings with a reputable real estate agent. They can provide valuable insights and guide you through the process.

Remember to inquire about Affordable homes in Miami and Fort Lauderdale anything that confuses you.

* Finally, stay persistent throughout the homebuying journey. Finding your dream home in South Florida can take time, but with a little effort and guidance, you'll be sipping margaritas by the pool in no time!

Tips for Mastering the South Florida Real Estate Market

Diving into the vibrant South Florida real estate market can feel daunting. But with the right guidance, you can thrive in this popular landscape.

Whether you're a first-time buyer or seller, understanding the regional characteristics of South Florida real estate is crucial. This resource will provide you with the insights to conduct informed transactions.

Here are some key factors to consider:

* Location, Location, Location: - South Florida is varied, with each community offering a special vibe.

* Understanding Supply and Demand- The real estate market in South Florida is constantly evolving.

* Navigating Interest Rates- Explore the various of financing options available to potential buyers.

Relocating to Paradise: A Homebuyer's Checklist for South Florida

Dreaming of sun-drenched days and balmy breezes? Embracing the hustle of your current life for the laid-back allure of South Florida is a dream many share. But before you pack your bags and head south, careful preparation is key to a seamless transition.

This checklist will guide you through the essential steps, ensuring a smooth journey into your new paradise:

- Research neighborhoods thoroughly. From vibrant coastal towns like Miami Beach to charming inland communities, South Florida offers diverse options to suit every lifestyle.

- Secure financing. With the dynamic real estate market in mind, it's crucial to get pre-approved for a mortgage before you begin your home search.

- Collaborate with a reputable real estate agent who specializes in South Florida properties. Their local expertise will be invaluable as you navigate the buying process.

- Consider factors like proximity to entertainment. Identify your priorities and find a home that aligns with your needs and desires.

- Don't forget about insurance! South Florida's unique climate necessitates specific coverage for hurricanes, flooding, and other potential risks.

By following this checklist, you'll be well on your way to making your South Florida homeownership dream a reality. Welcome to paradise!

Unlocking South Florida Living: Essential Tips for First-Time Buyers

Embarking on the adventure to homeownership in sunny South Florida can be both exciting and daunting. With its vibrant culture, pristine beaches, and thriving economy, this paradise attracts a multitude of individuals. However, navigating the real estate market here requires foresight. Here are some essential tips to assist first-time buyers through the process.

- Research Neighborhoods: South Florida boasts a diverse range of neighborhoods, each with its own unique personality. Take time to research different areas and find one that aligns with your lifestyle, budget, and desires.

- Arrange Pre-Approval: Getting pre-approved for a mortgage before you start house hunting is crucial. It highlights to sellers that you are a serious buyer and can accelerate the buying process.

- Collaborate with a Local Real Estate Agent: A knowledgeable agent who is familiar with the South Florida market can be invaluable. They can provide expert guidance, negotiate on your behalf, and help you traverse the complexities of buying a home.

Consider Insurance: South Florida is prone to hurricanes and other natural disasters. It's essential to include flood insurance into your budget.

From Sunshine to Shutters: What Every New Homeowner Needs in South Florida

Moving to South Florida is a dream for many, offering sunny skies and pristine beaches. But before you trade your winter coat for flip-flops, there are some key items every new homeowner needs to confirm a smooth transition from tranquil sunshine to the cozy comfort of home. A reliable climate control system is essential for beating the Florida heat, and hurricane shutters will shield your investment during sudden tropical storms.

- Don't forget a sturdy lawn mower to keep that lush South Florida lawn looking its best.

- Beyond the basics, consider investing in insect repellent, pool toys, and considerably a beach umbrella for those relaxing days by the ocean.

Your new home/ Your Florida abode/Your South Florida haven awaits! Make sure you're ready to enjoy all that it has to deliver.

Making the Move South: Your South Florida Homebuying Playbook

Ready to migrate your life to the sunny shores of South Florida? It's a desirable decision, but navigating the homebuying process in a new state can be challenging. Don't worry, though! With a solid plan and strategic guidance, you can smoothly purchase your dream home in paradise. Here's your South Florida homebuying playbook:

First, research the diverse neighborhoods that cater to your needs. From bustling city centers to serene coastal communities, South Florida offers a range of options to suit every taste. Next, partner with a reputable local realtor who understands the intricacies of the market. They'll advise you through each step, from identifying suitable properties to finalizing the best deal.

Bear that Florida is a humid climate, so consider factors like hurricane preparedness and flood insurance. Also, research local amenities, schools, and transportation options to ensure your new home meets your complete needs.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Katie Holmes Then & Now!

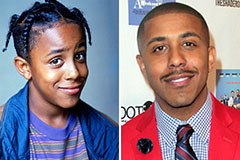

Katie Holmes Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! David Faustino Then & Now!

David Faustino Then & Now!